Child care subsidy - (CCS)

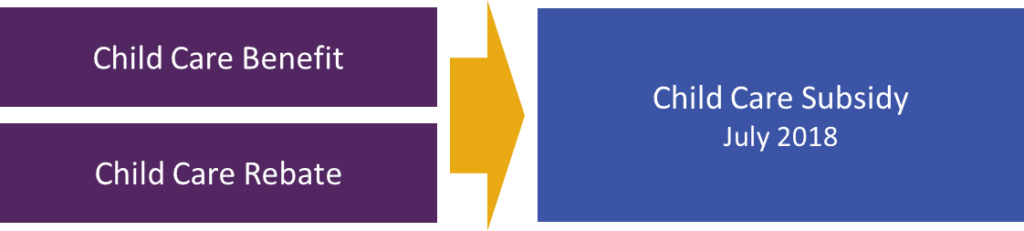

The Childcare subsidy is the primary way in which the Government assist families with Childcare fees. The Childcare Subsidy (CCS) commenced on the 2nd of July, 2018 and it replaced the Child Care Benefit (CCB) and Child Care Rebate (CCR) with a single means-tested subsidy.

Child care Subsidy Eligibilty

Some mandatory requirements must be satisfied for an individual to receive the Child Care Subsidy (CSS).

- The age of the the child (must be 13 or under and not attending secondary school, except in certain circumstances where an individual may be eligible for a child who does not meet this criteria, such as children with a disability or medical condition in certain circumstances).

- The child meeting immunisation requirements.

- The individual or their partner meeting the residency requirements listed in the legislation.

In addition, to be eligible for the Child Care Subsidy (CCS) the individual must be liable to pay for care provided, the care must be delivered in Australia by an approved Child Care provider, and not be part of a compulsory educational program.

Child Care Subsidy Entitlement

There are three (3) main factors that determine a family’s level of Child Care Subsidy (CCS). These are;

Activity Test ( The Activity level of both parents ), Service Type ( Type of Child Care Service and whether the child attends school ) and Combined annual family income. The Child Care Subsidy is generally paid directly to the service providers to be passed on to the families as a fee reduction. Families make a co-contribution to their child care fees and pay to the provider the difference between the fee charged and the subsidy amount ( GAP ).

There is also targeted additional fee assistance for vulnerable families through the Child Care Safety Net.